When will the increases for small businesses stop?

WORKSAFE Premiums for one small business in Inverloch have risen by over $5000 in a single year. Inverloch local Fred deBono manages the bookwork voluntarily for his sons business, Hue Beauty Painting Services. The business has been operating since...

WORKSAFE Premiums for one small business in Inverloch have risen by over $5000 in a single year.

Inverloch local Fred deBono manages the bookwork voluntarily for his sons business, Hue Beauty Painting Services.

The business has been operating since 2003 and hasn’t made a single WorkCover claim in that time.

“When he showed me this work cover insurance bill, and it had risen by over $5000, from one year to another, it just seemed ridiculous really,” Fred said.

WorkSafe premiums are calculated at different rates for different industries depending on the number of claims and the associated costs of the claims over the previous financial year.

Hue Beauty Painting Services is classified by WorkSafe as Painting and Decorating Services.

In the financial year 2019/20 the premium rate for this industry was 3.534 per cent equating to an annual cost of $4466, it rose incrementally in 2020/21 to 4.24 per cent and over the next two years to 4.713 per cent and 5.449 per cent respectively.

The rate owing for the 2023/24 financial year sky rocketed to 8.188 per cent, with the cost blowing out from an annual rate of $9388 from the previous year to $14,424 this year.

This is an increase of $5036 in a single year and an increase of $9957 over five years that this small business must pay to stay insured.

In regard to this issue, a spokeswoman from WorkSafe said,

“The greater than average premium increase for painting and decorating services has been driven by growth in both injury numbers and claims costs.”

The number of received injury claims made to WorkSafe in the Painting and Decorating Industry for the year 2019/20 was 91 and in 2022/23 was 95, and 84 and 94 for the years in between.

Costs of individual claims drive up this number, which is then passed on to small businesses, whether or not they have made a claim.

WorkCover state that the way rates are calculated is equitable and manageable for small businesses.

“WorkCover industry rates reflect the relative injury risk of that industry to ensure the scheme is fair and sustainable,” a spokeswoman from WorkSafe said.

“The business has always had an excellent safety record, which Workcover gives no consideration. It seems that businesses with good safety records are penalised for those larger companies with poor safety records. This is not right,” Fred commented.

“I can understand the reason they have it and to pay a reasonable amount, but on the other hand if someone has never had a claim and their injury record is perfect they get no reward for it,” Fred said.

“What I’d like to see happen is that the small businesses that have a good record should at least have a different rate to a big company that’s causing the problems. I think that’s the only way.”

“Anyone in a building industry like a plumber or an electrician or a painter, they’ll cop these charges and you’ve got to have it, if you’re going to start a business,” said Fred.

The Nationals Member for Gippsland South, Danny O’Brien, said he had been hearing from many Gippsland businesses in recent weeks about dramatic increases in their WorkCover bills.

“This week I spoke to a small South Gippsland business who’s WorkCover premium has risen 150 per cent against a wages bill that has only gone up 64 per cent,” Mr. O’Brien said.

“The bill has increased to over $30,000 which is a massive cost for a small business employing just a handful of staff.”

“The significant spikes in WorkCover charges come at a time when Victorian businesses can least afford them, with the price of goods and services increasing, rents and mortgages soaring and workforce shortages biting,” said Mr. O’Brien.

While Member for Bass, Jordan Crugnale said, “We know workplaces are feeling the effects of rising costs and WorkCover has options in place to assist businesses.”

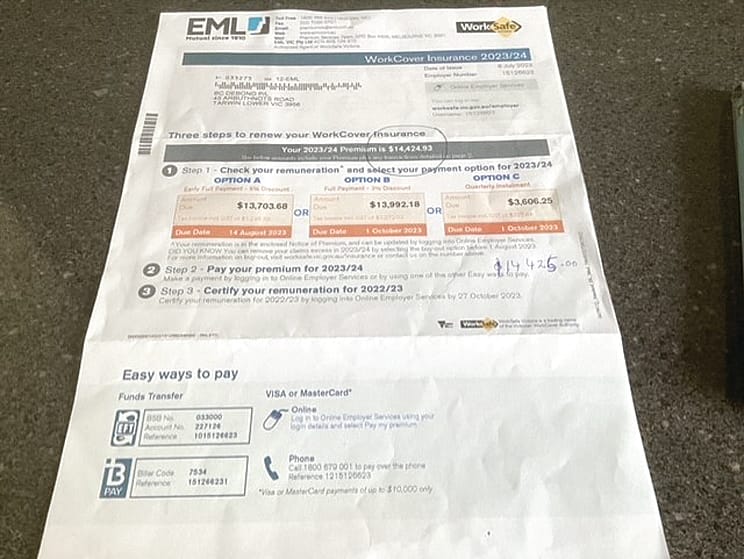

EML Mutual are the Workcover service provider, and the bill, according to Fred provides three different options to pay which offer two discounted rates.

A five per cent discount is offered if the invoice is paid by August 14, 2023, equalling approximately a $700 discount and a three per cent discount equating to about $430, if it’s paid by October 1, 2023.

The final option is for the payment to be made in quarterly instalments with the first payment of $3606 to be paid quarterly by October 1, 2023.

“They’re trying to give you some discount, but it’s just too much in one hit, so you don’t get the benefit,” Fred said.

“It gets paid quarterly because the cash flow of small businesses is not really big. No small business could afford to pay it up front to get the discount.”

“It’s time for the highly paid executives, to sit down at the board table and come with a fair premium for businesses that have great safety records,” said Fred.

WorkSafe’s answer to this proposition is that, “The best way for Victorian employers to ensure their industry rate is as low as possible for future premium years is to operate a safe and healthy workplace to prevent injuries from occurring.”

In response to Fred’s concerns, Jordan Crugnale MP said, “The government is delivering fundamental reforms to WorkCover and establishing Return to Work Victoria to ensure this vital scheme is sustainable.”

“I encourage the business owner who has raised this matter to contact WorkCover directly to discuss their premium calculation.”

Fred is left with a large bill in his hand, wondering at the sense and fairness of the policies of WorkSafe.

“Workcover is all about safety at work. You would think that WorkCover directors can offer some reward to a business of only two workers, with a perfect safety record, a twenty-year history of no claims,” said Fred.